Percent change and percentage difference sound like the same thing. They’re not though, and mixing them up causes confusion in business reports and science papers and news articles. Both involve percentages, both compare two numbers, but they measure different stuff and the calculations aren’t the same.

What Percent Change Actually Measures

Percent change shows how much something went up or down from where it started. The key thing is having a starting point that you’re measuring from.The formula puts the original value on the bottom, that’s what makes it percent change specifically instead of something else. You’re asking “how much did this change compared to where it was before?” Direction matters here. Increases are positive, decreases are negative. Stock went from $100 to $80, that’s a negative 20 percent or a 20 percent decrease depending how you want to say it. Time usually plays a role even if nobody states it directly. The population grew by 15 percent probably over a year unless they specify otherwise. Interest rates have changed by 2 percentage points since last quarter, the “since” signals you’re looking at change from a starting point. Though sometimes people leave that context out and you have to figure it out from what they’re talking about.

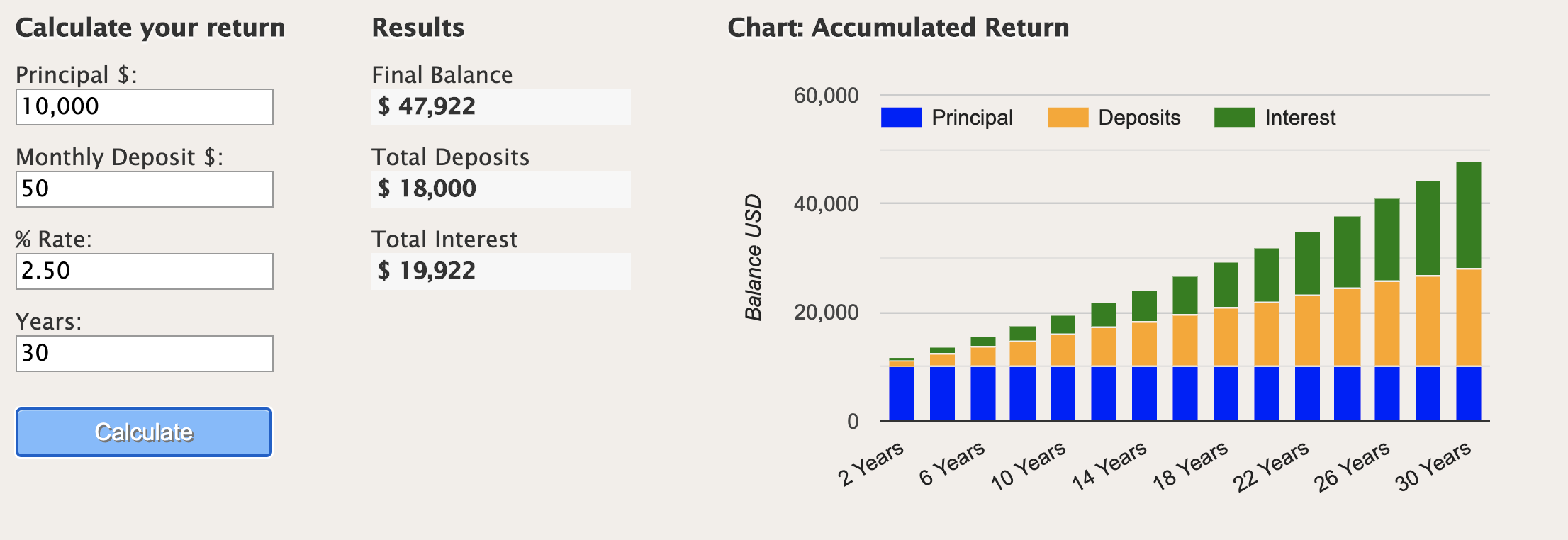

A percentage calculator helps verify calculations when you’re not totally sure which formula to use or the numbers are messy. Plug in values, specify if you want percent change or percentage difference, check that the result seems reasonable. Useful for financial stuff, data reporting, situations where getting the math wrong matters. Manual calculation catches errors though that just relying on tools might miss. If a percentage seems way too high or too low, work through it by hand to find the issue. Maybe you used percentage difference when you should’ve used percent change or the other way around. Maybe you were divided by the wrong thing. Checking your work matters more than people think because percentage mistakes aren’t always obvious looking at the final number.

What Percentage Difference Measures

Percentage difference compares two values without saying one is the starting point necessarily. It measures how different they are from each other compared to their average, which is a different question. Two stores sell the same thing, one charges $45 and the other charges $55. For percentage difference you find the absolute difference which is $10, divide by the average of both which is $50, multiply by 100 to get 20 percent.

This matters when neither value is the baseline. Comparing test scores between two students, neither score is the “original” so percentage difference makes more sense. Same with comparing measurements from two different instruments or prices in two cities at the same time, there’s no before and after just two different things.

Why People Mix These Up

Both calculations involve dividing a difference by something then converting to percentage, so they look similar if you’re not paying close attention. Confusion gets worse because in regular conversation people say “what’s the percentage difference” when they mean “what’s the percent change” actually. Or they use the terms like they’re interchangeable without realizing the math is different. News articles are terrible about this. “Prices are 30 percent different between stores” could mean anything. Is that percent change from one store’s price to another’s? Percentage difference from their average? Just a vague statement with no actual calculation behind it? You can’t know without seeing the actual math they did.

When to Use Each One

Percent change works for tracking something over time or measuring impact. Company revenue last year versus this year, that’s percent change territory. Weight before and after a diet, percent change. Test scores before studying versus after studying, percent change. Anything with clear before and after, use percent change.

Percentage difference works for comparing two independent measurements that happened at the same time kind of. Comparing prices between two stores right now, percentage difference. Comparing test scores between two different students, percentage difference. Comparing measurements from two different labs, the percentage difference makes more sense. When neither value is the reference point, basically.

Common Mistakes with These Calculations

Forgetting about direction with percent change causes issues. A 20 percent decrease followed by a 20 percent increase doesn’t get you back to where you started, surprises people when they realize this. Start at $100, decrease by 20 percent gives $80. Increasing $80 by 20 percent gives $96 not $100. The percentages are the same but they apply to different bases so the dollar amounts are different.

Comparing percent changes from different bases misleads constantly, happens in news all the time. Company A grew revenue by 50 percent and Company B grew revenue by 30 percent, it seems like Company A did way better. But Company A might have started at $1 million and Company B at $100 million, the actual dollar growth is completely different. Percentages without context about underlying values can be meaningless really.

Financial reports use these everywhere. Stock performance, revenue growth, market share changes, all reported as percentages. Knowing if they mean percent change or percentage difference affects how you interpret the numbers actually. A 10 percent change means something specific, but if they calculated it wrong the number doesn’t mean what it looks like it means. Scientific papers need precision about these. Percentage difference between experimental and control groups versus percent change from baseline measurements, those are different things and the methodology should be clear. Papers sometimes say “percent difference” when they calculate percent change, creating confusion trying to replicate results or compare across studies.

Conclusion

The distinction isn’t just academic stuff, it affects real decisions. Percent change measures movement from a starting point, has direction, tracks change over time. Percentage difference measures how far apart two values are without treating either as the baseline, doesn’t have direction, compares independent measurements.

Getting comfortable with both takes practice and paying attention to context. What question are you actually asking? Are you measuring change from a baseline or comparing two independent values? That determines which calculation makes sense to use. Using the wrong one doesn’t always produce obviously wrong results which is part of the problem, the number might seem fine but represent something different than what you think you calculated. That’s why the distinction matters, the math works either way but only one way answers the question you’re actually trying to answer.