Achieving early retirement is a goal that many individuals aspire to, allowing them to enjoy financial independence and pursue their passions. While the concept of retiring early may seem daunting, it is not an unattainable dream. By understanding the fundamental mathematical principles and implementing key strategies, anyone can embark on the path to early retirement. In this article, we will explore the simple math behind early retirement and discuss practical steps to make it a reality.

The Power of Saving

Saving a significant portion of your income is crucial for early retirement. Let’s consider an example: Suppose your annual expenses are $40,000, and you aim to retire when you have accumulated 25 times your annual expenses, as suggested by the 4% rule (discussed later). In this case, you would need to save $1 million ($40,000 x 25) before you can retire. By saving more each year, you accelerate the accumulation of your retirement savings and bring early retirement closer.

The 4% Rule

The 4% rule is a commonly used guideline in retirement planning. It states that if you withdraw 4% of your investment portfolio’s initial value in the first year of retirement and adjust subsequent withdrawals for inflation, your money should last for at least 30 years. To apply this rule, determine your desired annual retirement expenses and multiply that amount by 25. For example, if you want $40,000 in annual expenses, you would need to accumulate $1 million ($40,000 x 25) before retiring. This calculation ensures you have enough saved to sustain your lifestyle throughout retirement.

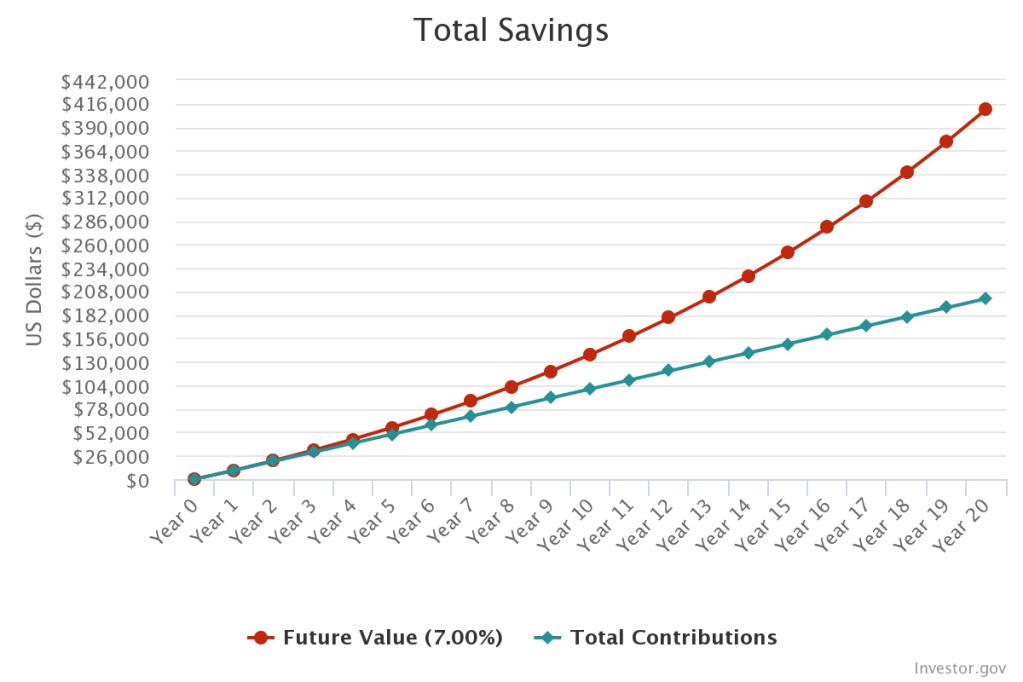

The Magic of Compound Interest

Compound interest is a powerful force that can significantly impact your savings. Let’s say you start saving $10,000 per year at age 25 and invest it in a retirement account with an average annual return of 7%. By the time you reach age 45, you would have contributed a total of $200,000 ($10,000 per year for 20 years). However, thanks to the compounding effect of interest, your retirement account balance would be approximately $410,000, more than double your total contributions. This example highlights the importance of starting early and letting compound interest work over a long period.

The Role of Return on Investment

The return on your investments plays a vital role in determining when you can retire. Consider the following example: Suppose you aim to accumulate $1 million for retirement, and you save $30,000 per year. If your investment portfolio has an average annual return of 5%, it would take approximately 21 years to reach your goal. Here’s how the calculation works: After the first year, you would have saved $30,000, and with a 5% return, your balance would be $31,500. In subsequent years, you save an additional $30,000 and earn a 5% return on your growing balance. By the end of 21 years, your savings would have grown to approximately $1 million. However, with a higher return of 8%, you could achieve the same target in around 17 years. The power of compounding is amplified by higher returns, enabling you to reach your retirement goals sooner.

The Time vs. Money Trade-Off

Early retirement requires finding the right balance between saving aggressively and enjoying life along the way. Saving a higher percentage of your income allows for a shorter accumulation phase. Evaluating your priorities and determining the optimal savings rate can help you align your financial and lifestyle objectives.

Reducing Expenses

Reducing expenses is a crucial aspect of early retirement. By identifying areas where you can cut back and adopting frugal habits, you can accelerate your savings growth. For example, reducing your annual expenses by $5,000 can save you an additional $125,000 over 25 years. Every dollar saved not only reduces your expenses but also lowers the amount you need to save for retirement.

Conclusion

Achieving early retirement is a realistic goal when armed with the knowledge of the simple math behind it. By saving a significant portion of your income, following the 4% rule, harnessing the power of compound interest, and carefully managing your investments, you can pave the way to financial independence sooner than you might have thought possible. Remember to find the right balance between saving and enjoying life along the way, and stay flexible to adapt to changing circumstances. Start crunching the numbers and take the first steps towards the fulfilling and liberating journey of early retirement.